Lecture 8: Inflation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Let's turn to the monetary sector. For convenience, we will repeat Figure 4-5 here as Figure 8-1. Our primary interest here is the equation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

P = MV/y |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This provides our basis for a more detailed look at inflation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The price level, like the price of any commodity, is determined by the supply and demand. In this case, it is the supply and demand of money itself. Our discussion of inflation must therefore begin with a discussion of money supply and money demand. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Why Money Matters |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Money itself is an incredibly important invention, even more important than the wheel. Our economy would stop without it. To see why, imagine an economy with no money. If Barney wanted eggs for breakfast, he would have to raise his own chickens or go see farmer Fred to buy some eggs. Without money, he would have to offer farmer Fred some good or service that farmer Fred wanted. Barney would barter with farmer Fred for the eggs. (Barter is the direct exchange of one good or service for another, without the use of money.) Barney would only get the eggs if he had a good or service that farmer Fred wanted and if Barney and farmer Fred could come to an agreement on the terms of the exchange. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Money greatly simplifies this transaction. It is a lot easier for Barney to separate the two transactions. He offers Fred money for eggs and Barney finds who will pay him the most for his work, without having to worry about matching his skills with Fred's interests. Our ability to use money in market transactions depends, however, on the grocer’s willingness to accept money as a medium of exchange. The grocer sells eggs for money only because he can use the same money to pay his help and buy the goods he himself desires. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Money Supply and Demand |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Supply |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The money supply is whatever the federal government wants it to be. (There are several complications, but we will take them up later). Over the past century, the government has kept us well-supplied – perhaps too well supplied with money. For example, the supply of currency and coins is now about $513 billion, as compared to the roughly $1 billion at the turn of the century. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

While there is a lot more to be said, let us leave it there for the moment and turn our attention to the determinants of the demand for money. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Money Demand |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Why do people hold money? If I walk around with say, $100 in cash, it costs me something. I could take that money, put it in (say) a certificate of deposit, and earn interest. The foregone interest is the opportunity cost of holding money. I choose to hold cash and give up the interest because it facilitates buying goods. I would incur large transaction costs if I were buying and selling assets all the time to avoid holding money. It would be madness to cash in a stock or bond every time I wanted to purchase something from a vending machine. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

While the amount of money each of us holds varies significantly from day to day there is, on average, a relatively constant average money balance (or average money demand) across individuals. For example, the average money balance could be equal to 5.2 weeks income. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Several things can change the demand for money. A partial list would include the price level, real incomes and interest rates. For the moment, let us concentrate on changes in the price level. Suppose all prices double. Thus pizza costs $2 a slice rather than $1 a slice. At the same time, wages double as well, rising from (say) $10 an hour to $20 an hour. Economists believe that the demand for real money balances (money balances measured in terms of purchasing power) would remain unchanged. That is, people would still want to hold (say) an average of 5.2 weeks income, translating into a doubling in the number of pictures of George they want to hold. The public holds as much nominal money balances (measured in the number of pictures of George) as required to get that purchasing power they desire. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Figure 8-2 shows the demand for money as a function of the price level (actually 1/P; if pizza costs $2 a slice, the price of a picture of George is half a slice of pizza). Do not go over this point lightly. Make sure you understand it. We normally put the demand curve for pizza, for instance in terms of dollars. That is, how many pictures of George do you have to give up for a slice of pizza? When we are graphing the demand for money, we must put it in similar but reverse terms: how many slices of pizza must you give up to get a picture of George. That turns out to be 1/P. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Look again at the price axis of Figure 8-2. Remember that the graph measures 1/P not P. Thus moving up the graph means lower prices; moving down means higher prices. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The figure also shows the supply of money, measured in terms of pictures of George. At any point in time, there are only a fixed number of pictures of George, so the supply curve is a vertical line. The equilibrium occurs when the price level equals Po. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Similar graphs allow us to show what will happen when there is an increase in money demand or money supply. Suppose, for instance, the demand for money rises to Md'. Figure 8-3 shows what will happen. The equilibrium will move to 1/P1, which is greater than 1/Po. Of course, this means that P1 will be less than Po. Prices will fall. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Finally, let us see what happens when there is an increase in money supply. As Figure 8-4 shows, the money supply moves to Ms', and the price level rises to P2 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Equation Equating the Supply and Demand of Money |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

It is also important to do supply and demand in terms of an equation, which we can write as |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Md

= Ms

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Using the basic quantity equation: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

MsV = Py

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ms

= Py/V

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If we turn this equation around, we get |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

P = VMs/y,

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

We can, with some algebra, rewrite it as |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Growth in Prices @ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Growth

in the Money Supply - Growth in GDP + Growth in Velocity

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

That is, the inflation rate equals the rate of growth of the money supply less the rate of growth of real output plus an allowance for the change in velocity. Most of the time, we ignore the velocity term and rewrite the equation as |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Growth in Prices @

Growth in the Money Supply - Growth in GDP

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

% DP @ %D MS - %D GDP |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If the money supply is growing at (say) six percent and the rate of growth of real output is (say) two percent, the inflation rate is four percent. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A Digression |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Let us interrupt the flow of the lecture and show just how we get from the statement that MV = Py to the statement that |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Growth

in Prices @

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Think of the equation MsV = Py. This equation holds both this year and last year, which we will denote as time "t" and time "t-1". Thus |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(1) MstVt

= Ptyt |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

and |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(2) Mst-1Vt-1

= Pt-1yt-1 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If we divide equation (1) by equation (2), we get |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(3) (Mst/Mst-1)(Vt/Vt-1)

= (Pt/Pt-1)(yt/yt-1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Now look at the first term, Mst/Mst-1. We can rewrite Mst as |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(4) Mst

= Mst-1 + DMs |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

so that the first term then becomes |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(5) (1

+DMs/Mst-1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In words, this is one plus the percentage growth in the money supply |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If we similarly write the other terms in equation 3, we get |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(6) (1

+DMs/Mst-1)

(1 +DV/Vt-1)

= (1 +DP/Pt-1)

(1 +Dy/yt-1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If we expand this expression out, admittedly a messy job but not a difficult one, we get |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(7) 1

+DMs/Mst-1

+DV/Vt-1 + (DMs/Mst-1

)(DV/Vt-1) = |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Drop

the ones from both sides, and forget about the two terms |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(8) DMs/Mst-1

+DV/Vt-1 » +DP/Pt-1 +Dy/yt-1 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

where "@" means is approximately equal to. Remember that we dropped the cross product terms. By moving terms from one side to the other, we get |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(9) DP/Pt-1 @ DMs/Mst-1

+DV/Vt-1 - Dy/yt-1 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Of course, this is the equation we wanted. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

While this derivation will not appear on any examination, you should see that this equation does not come out of thin air. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Quantity Theory of Money |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The model we have been developing here is the Quantity Theory of Money, which implies that: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The primary cause of inflation is the rate at which the money supply increases. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If it increases more than the level of real output, we get inflation. If it increases less than the level of real output, we get deflation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

An Illustration of the Quantity Theory of Money: The Helicopter |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Some economists illustrate the quantity theory with the helicopter story first presented by Milton Friedman. Suppose a helicopter drops new money equal to the amount in circulation, so that the money supply is doubled. (If you want to be fussy, the helicopter will make sure that part of the money is in currency and part is in demand and time deposits). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The helicopter has doubled the nominal money supply, but has not changed the demand for money in terms of purchasing power. The only way the supply and demand of money can equal is for the price level to double. Then the demand for George’s picture will have doubled as well. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This is the quantity theory of money. In its crudest form, it states that the price level changes in direct proportion to the supply of nominal money balances. Thus, if we were to burn a dollar bill and reduce the nominal money stock by 10-9 percent, the price level would fall by 10-9 percent. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Does the Quantity Theory Always Work? |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

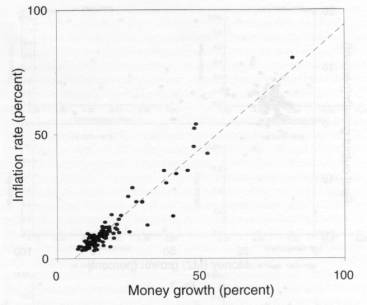

Figure 8-5, taken from Bob Lucas’s Nobel Prize Lecture shows, for something like 100 countries, data on the inflation rate and growth of the money supply. As you can see, there is a clear correlation between the inflation rate and money supply. High money growth means high inflation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Pay attention to the intercept of the trend line. It suggests that price stability (zero inflation) occurs when the money supply is growing at a small rate. Our equation shows that inflation equals the rate of money growth less the rate of GDP growth. Since GDP has generally been growing throughout the world, we would expect prices to be stable when the money supply is growing at a small rate. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Quantity Theory is obviously at work when there is hyperinflation, sometimes defined as inflation of 100% a year or higher. Figures 8-6, 8-7, 8-8, and 8-9 show data from four hyperinflations during the 1920's. In each case, the price level tracks the money supply quite closely. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

We could look at other episodes, including |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· Latin American Countries, |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· Hungary after World War II, and |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· Russia after the breakup of the Soviet Union. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Does it Work in the United States? |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

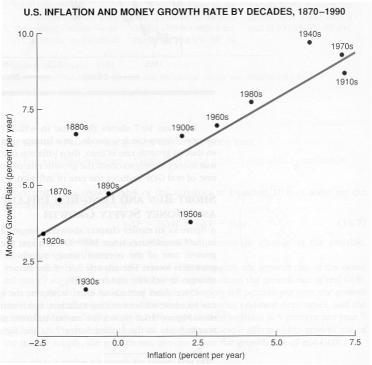

Of course, but like many economic laws, it does not work perfectly with mathematical precision. See Figure 8-10, taken from Stockman, which plots inflation rates and money supply growth rates decade by decade. The relationship is not perfect. Both the 1940's and the 1880's were periods of higher than predicted inflation. Nevertheless, the relationship is clear. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

What determines Inflationary Expectations? |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

We don’t do economic forecasting in this class. Most economics forecasts are poor and there is no reason wasting our time on an impossible task. However, one area of forecasting is important to us and that is the expected inflation rate. We have already studied the basic Fisher equation relating real and nominal interest rates: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

rN @

reR + pe, |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

or, to put it in words, |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Nominal Interest Rate = Real Interest Rate + the Expected Inflation Rate |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Inflationary Expectations |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Clearly inflationary expectations change, sometimes dramatically so. Changing expectations are a major cause of fluctuations in nominal interest rates. What determines the expected inflation rate? Any forecasts you and I might make about inflation in the future are (a) probably pretty bad and (b) of no real interest. What is interesting is how the market sets the inflationary expectations that are built into (or embodied in) nominal interest rates. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All we know for sure is that |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· The market is often wrong. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· The market is as often too high in its forecasts as it is too low. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

When some development comes along (Alan Greenspan has a cold and someone else must run the meetings of the Board of Governors), the market estimates the impact this will have on the inflation rate and adjusts its forecasts accordingly. These adjustments are often wrong but on average, they are right. In sum, we say that the market has rational expectations about inflation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If you want to know what the market's expections about inflation are, that is an easy task. Differences in real and nominal rates show those expectations. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gains and Losses from Inflation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

How often do we hear that “Inflation robs us all”? Not true. Let me give some areas where this is not true. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Private gains and losses from unanticipated inflation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The gains and losses from unanticipated inflation on private assets exactly balance out. A loss on a private asset is matched by someone else’s gain. As an example, Fred owns Miller’s Pizzeria with a market value of $100,000, but with an $80,000 mortgage, held by Barney. (Actually, if Barney is smart, he has his money in a portfolio of mortgages, but let’s keep the story simple). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The interest rate that Barney would

charge Fred for the $80,000 mortgage would be determined by the Fisher

Equation: rN @ reR + pe |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Now suppose that there is a unanticipated doubling of prices. In this case there would be a difference between the expected inflation rate, pe, and the actual inflation rate, p, that difference being 100%. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

What happens to the balance sheet of Fred and Barney with this unanticipated inflation? Consider first the statement in nominal terms and second the statement in real (purchasing power) terms. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

If we look at the changes in real terms, it is clear that Fred’s gain exactly balances Barney's loss. Looking at the nominal assets might suggest that Fred has gained at no loss to Barney. In fact, their combined purchasing power has risen, in nominal terms, from $100,000 to $200,000, which means that they have simply stood still. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The gains and losses from anticipated inflation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The effects illustrated above simply do not happen, thanks to the nominal interest rate adjusting to include expected inflation. The expected inflation rate would increase, pe in the Fisher Equation, and would equal 100%, thereby increasing the nominal interest rate. In our simple example with the $80,000 mortgage, for instance, an expected inflation rate of 100% would translate into to a $80,000 interest payment from Fred to Barney, exact compensation for the impact of inflation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

At the end of the year, Fred would owe an additional $80,000 so that the balance sheet would look like the following: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Changes in Prices

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Most of the complaints about inflation reflect changes in relative prices, and not changes in the overall price level. Consider the case of college tuition. Suppose that tuition goes up by 4% one year while the overall inflation rate is 2%. The real problem is that the relative price of tuition rose by 2%. To say that students felt a larger effect of inflation would be incorrect. What would have happened to tuition if the price level had risen by say 10%? Most likely college tuition costs would have risen by 12%. In addition, if there had been zero inflation, college tuition rates would have risen by 2%. In sum, rising college tuition costs hurt students just as declining computer prices help computer users. But the villain is changing relative prices, not inflation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Myths of Inflation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Exchange Rates |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Normally we talk about the price of (say) a slice of pizza in terms of pictures of George. However, we can also discuss the price of a picture of George in terms of a picture of Her Majesty Elizabeth II. That is the determinants of the rate at which you can exchange George for Liz, or to be more precise and formal the rate at which you exchange dollars for pounds. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Exchange rates fascinate people. It has always been good cocktail party

conversation - at least at the cocktail parties economists frequent. To be sure, the particular exchange rate

of interest will vary from year to year.

The quick and dirty answer to the question of what determines exchange

rates is quite simple: the laws of supply and demand determine them. However, you may not want to leave the discussion

at this point. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Foreign Exchange Rates |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· A foreign exchange rate is the price of one currency in terms of another, often expressed as the (home-currency or domestic-currency) price of one unit of foreign currency. People use exchange rates to convert prices from one currency into units of another currency. For example, the exchange rate for Canadian Currency is now approximately 68 cents. That is, you can purchase a Canadian dollar for $0.68 in American dollars. A Canadian might think of the exchange rate the other way as 1/0.68 = 1.47. That is, an American dollar costs $1.47 in Canadian funds. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· A currency appreciates when its value on the foreign exchange market rises, so that one unit of home money buys more units of foreign money. In the case of an appreciating US dollar you receive more foreign currency for your US dollars, we would say that the US dollar appreciated in relation to that foreign currency. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· A currency depreciates when its value on the foreign exchange market falls, so that one unit of home money buys fewer units of foreign money. In the case of a depreciating US dollar you receive less foreign currency for your US dollars, we would say that the US dollar depreciated in relation to that foreign currency. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Purchasing Power Parity Model of the Exchange Rate |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Some economists have attempted to explain exchange rates in terms of Purchasing Power Parity (PPP). Purchasing Power Parity states that $1 should buy the same amount of goods and services in the US as does a dollar’s worth of a foreign currency in that foreign country. A dollar’s worth of Yen in Tokyo should buy the same goods in Japan as a dollar would in the US. If PPP does not hold then arbitrage opportunities would exist. That is, you could buy goods in one country and sell them for a higher price in the second country. Table 8-5 shows how PPP should work. If gold sells for $400 an ounce in the United States and $600 (C) in Canada – on in words, 600 Canadian dollars – then the exchange rate should be $1 US = $1 C. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Traded vs. Non-traded Goods |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Alas, purchasing power parity does

not work in general. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In discussing purchasing power parity, economists distinguish between traded and non-traded goods. If the cost of shipping a good from one area to another is relatively low, it is a traded good. If the cost is high, it is a non-traded good. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

A shipload of crude oil in Osaka harbor is an easily traded good. If the price in New York harbor is higher, at the current exchange rate, an arbitrage opportunity exists, and it is a simple matter to turn the ship around and head for the US. A house in Tokyo, however, is a non-traded good. Even if US houses are a better buy, it is prohibitively expensive to ship a house from one country to another. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Traded Goods |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In the case of traded goods, we expect them to sell at the same price ratio as the exchange rate, That is |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Price of Crude Oil

(in ¥) = Price of ¥ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Price

of Crude Oil (in $) $ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Put another way, Pd = EPf, where: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Pd: = the price in domestic

currency. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

E = the

exchange rate between the two currencies. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Pf:= the price in foreign currency. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If pencils sell in Tokyo for (say) 100 ¥ and if the exchange rate is $1 = (0.01)¥, then pencils should sell in the United States for a dollar. In short, exchange rates adjust so that a dollar buys just as much as does a dollar’s worth of Yen. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Non-Traded Goods |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The same results do not hold for non-traded goods, which are costly to move from one country to another. Arbitrage will not equate the price of non-traded goods around the world. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A Quick Quiz to Test Your Knowledge of Traded and Non-Traded Goods |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Suppose gold sells for $400 an ounce in Cleveland and 400 € in Paris, and a piece of Pizza sells for $2 in Cleveland and 3 € in Paris. What is the exchange rate between dollars and Francs? |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Table 8-6 shows two ways of doing these calculations. Given these data, the exchange rate has to be 11. Gold is a traded good (while it cannot be shipped for free, shipping costs are small relative to value to its value), and the price of gold must reflect purchasing power parity. At the exchange rate of 1:1, a piece of pizza bought in Paris will cost only $1.5, less than the Cleveland price. The costs of buying pizza in Paris and rushing it to Cleveland to arbitrage the market are so high that the relative price of pizza gives little clue to the exchange rate. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Big Mac Index |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Economists sometimes talk about the Big Mac Index, published yearly by The Economist, which checks on the price of a Big Mac, in cities around the world. It then computes the cost of living in different cities by comparing the prices adjusted for exchange rates. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

While the Economist presents the Big Mac Index tongue in cheek, more detailed studies give answers that are similar to the Big Mac Index. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

While a Big Mac can have different prices in different cities, it does not pay to go to from New York City to Bangkok just to buy a Big Mac. The costs incurred in getting to Bangkok outweigh the money saved by purchasing a lower priced Big Mac. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

What follows is excerpted from the Economist's discussion of the 1999 Big Mac Index. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Implications for Inflation Rates and Exchange Rates |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Common sense says that PPP works only so well. A dollar spent in Ohio will not buy the same goods in Manhattan. While it works for many goods such as computers, it does not cover non-traded goods, as anyone who has rented an apartment in Manhattan will understand. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

A variant of PPP predicts that exchange rates move with the inflation rate. If Japan has an inflation rate X% lower (higher) than the United States, then this version of PPP predicts that the value of the Yen should also appreciate X% relative to the dollar. For example, suppose a pencil costs $1 here and ¥100 in Japan. If the exchange rate is also $1 = ¥100, we have purchasing power parity. If inflation now causes the price of a pencil to double to $2 in the United States, while Japanese prices remain stable, then the exchange rate must move to $1 = ¥50 to maintain purchasing power parity. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Does PPP fit the facts? |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· PPP clearly works in hyperinflation, that is, periods of rapid inflation (at least 100 percent per year). During hyperinflation, the domestic currency exchange rate generally changes in step with changes in the inflation rate. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· However, PPP doesn’t work that well when confronted with minor inflation rates such as those usually found in industrialized countries. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· The theory does not do a good job for non-traded goods. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· Even predictions for traded goods have a problem. Almost any real “good” is a combination of traded and non-traded goods. Since the theory does not explain movements in non-traded goods, it really doesn’t do a good job for any real good. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest Rate Equalization |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

An alternative model of explaining exchange rate movements does work well: Interest Rate Equalization. Differences in interest rates do predict exchange rate changes. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

An example – laid out in Table 8-7 will clarify the issue. Suppose |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· Investors expect that the exchange rate between the United States and Japan will be $1 = ¥100 next year, and that |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

· The nominal interest rate is currently 5% in Japan and 10% in the United States. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The exchange rate now must be $1 = ¥105. To see why, consider an investor planning to invest $1,000,000. If she invests it in dollars, she will have $1,100,000 a year hence. If she converts her dollars into yen at an exchange rate of $1 =¥105, she will have ¥105,000,000 now and approximately ¥110,000,000 a year hence. (Actually, she will have ¥110,250,000 a year from now, but to keep the example simple, we have rounded the numbers). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If the exchange rate is not $1 = ¥105, arbitrage opportunities will abound. Borrowing in dollars and investing in yen, or vice versa can make money. In short, arbitrage opportunities force the expected exchange rate changes to equal the difference in interest rates. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

While both Purchasing Power Parity and Interest Rate Equalization predict what the exchange rate is, neither of these can be used to show how exchange rates are determined. That story is being saved for a later lecture. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Relation to the Text |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Each lecture ends with a section relating it to the text. In some cases, material is omitted, either because the text covers it well enough or because it is not worth learning. In other cases, material is added. Each of these “lectures” will end with a brief note relating the lecture to the text, describing what material is left to the student to learn alone and what material may safely be skipped. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Which Chapters does this lecture cover? |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

What material is new? |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Interest Rate Equalization |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

©2000 by

Greg Chase and Charles W. Upton. If

you enrolled in Principles of Macroeconomics at Kent State University, you

may print out one copy for use in class.

All other rights are reserved. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

![[Image]](./ma08_files/image025.gif)