Hylton's, a popular beach-area restaurant, was started five years ago by Nann Hylton as a small catering business. After five years as a catering operation, Nann had the opportunity to expand to a full-scale restaurant. Her business has been successful, in part, because she has adhered to the central business principle she learned long ago: offer the customer a good meal at a fair price. However, Nann realizes that she must alter some of her operations as she moves to a full-service restaurant business.

One operational activity that Nann is considering changing is the process the firm uses for payroll. With approximately 25 new employees being added to Hylton's existing payroll of 10, the change in the workload of the people responsible for payroll is significant.

The present payroll system used by Hylton's employs both automated and manual processes. The automated processes, however, are either data sources for the manual payroll activities done at Hylton's or serve as destinations for Hylton's payroll processing activities.

An automated source of data for the payroll process at Hylton's is their NCR 2160 cash register. This machine was primarily intended for use as a cash register, but it also maintains a number of data files that are potentially useful for other business functions, including one for employee timekeeping.

At Hylton's, employees initiate the daily timekeeping process when they begin their shift and clock in via the 2160; they also use the machine to clock out at the end of their shift. The employee timekeeping data file generated by the NCR 2160 can store up to one week of timekeeping data. However, Nann has not explored using the 2160 timekeeping data more fully because she pays her employees every two weeks.

At the close of each business day, the operations manager, Kristin, reviews a daily timekeeping tape from the 2160. Kristin checks the tape for errors (e.g., an employee forgets to clock in or clock out), and makes the necessary adjustments to the employee timekeeping records on the 2160.

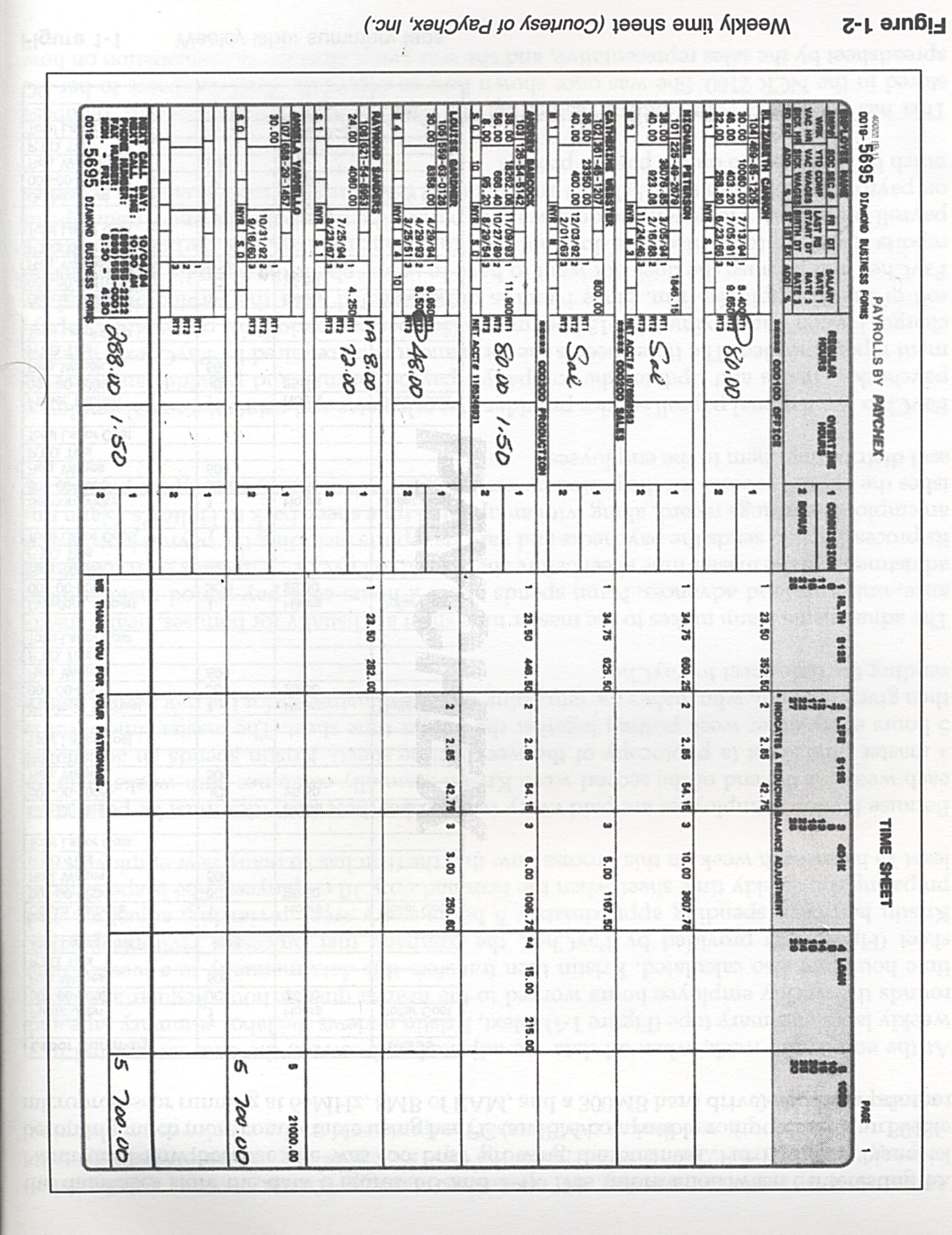

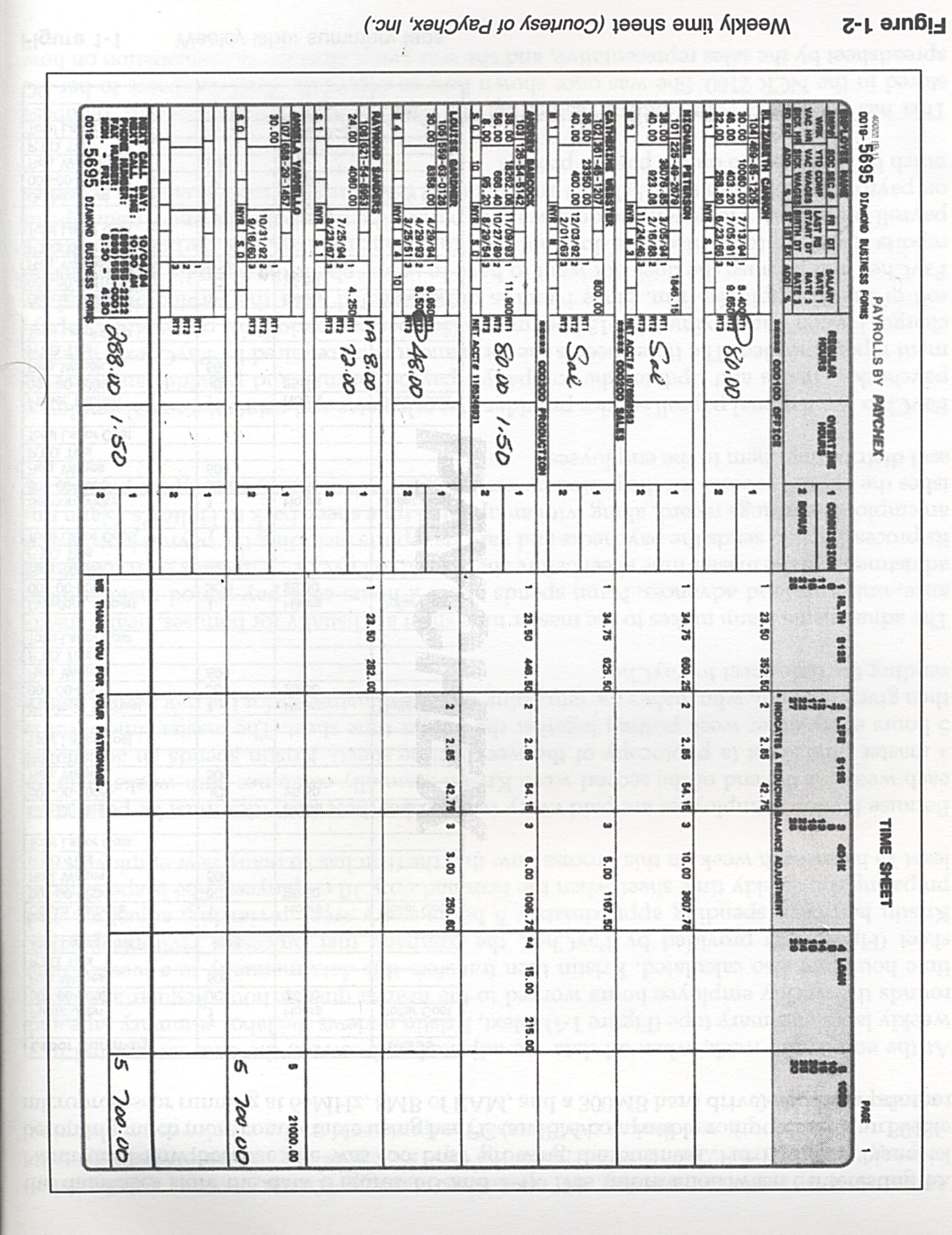

At the end of the week, when all data are adjusted and correct, the data are printed to a weekly labor summary tape (Figure 1-1). Next, Kristin reviews the labor summary tape and rounds the weekly employee hours worked to the nearest quarter hour. Regular and overtime hours are also calculated. Kristin then transfers this data manually to a weekly time sheet (Figure 1-2) provided by PayChex, the company that processes Hylton's payroll. Kristin had been spending approximately 5 hours every week reviewing, adjusting, and preparing the weekly time sheet when the firm had only 10 employees. She is spending at least 15 hours each week on this process now that the firm has so many new employees.

Because Hylton's employees are paid every two weeks, these activities must be performed each week. At the end of the second week Kristin manually combines both weeks' data on a master time sheet (a photocopy of the weekly time sheet). Kristin spends an additional 5 hours every other week putting together the master time sheet. The master time sheet is then given to Nann, who makes the remaining payroll adjustments for the pay period before sending the time sheet to PayChex.

The adjustments Nann makes to the master time sheet are usually for bonuses, health insurance, uniforms, and advances. Nann spends about 2 hours each pay period making these adjustments to the master time sheet before she faxes it to PayChex. PayChex then completes its processing and sends the paychecks and various reports including the payroll journal and an employee earnings record, along with an updated time sheet, back to Hylton's. Nann finishes the payroll process for the period by verifying the calculations, signing the paychecks, and distributing them to the employees.

PayChex is a national payroll service provider that calculates and prints the actual employee paychecks, creates and updates the company's payroll journal, and provides any government reports needed. The time sheet is the form and format required by PayChex. PayChex charges Hylton's approximately $130 per month ($65 per pay period) for processing the payroll of the 35-employee firm. Since Nann is quite satisfied with the service provided by PayChex and because she does not want to have to worry about the periodic governmental reports that need to be filed, she does not plan to change the PayChex portion of Hylton's payroll processing. However, she does want to reduce the time both she and Kristin spend on payroll. Both Kristin (at $15/hour) and Nann (at $50/hour) are too valuable to spend as much time as they do on the payroll process.

This has prompted Nann into investigating the usefulness of the timekeeping database stored in the NCR 2160. She was once shown how to export the 2160 databases to her PC spreadsheet by the sales representative, and she was given all of the documentation on how the databases store the data (Figures 1-3 and 1-4). This information wasn't interesting to Nann until now because she was too busy growing the business. Furthermore, Nann is becoming much more comfortable using her PC (an IBM-compatible computer with an 80486 microprocessor running at 66MHz, 8MB of RAM, and a 300MB hard drive) and laser printer.

|

Labor Summary |

|

|

10/8195 |

|

|

|

|

|

|

Purdy, John |

1 |

Hours |

Dollar Cost |

|

001-00-0003 |

JC |

25:50 |

|

|

Rea. Waaes |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

|

|

|

|

|

|

Cooke, Isabella |

1 |

Hours |

Dollar Cost |

|

002-00-0004 |

JC |

25:50 |

|

|

Rea. Waaes |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

|

|

|

|

|

|

lavicoli, Rita |

1 |

Hours |

Dollar Cost |

|

003-00-0005 |

JC |

25:50 |

|

|

Rea. Waaes |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

|

|

|

|

|

|

Peterson, Michael |

1 |

Hours |

Dollar Cost |

|

004-00-0006 |

JC |

25:50 |

|

|

Rea. Waaes |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

|

|

|

|

|

|

Crawford, Robert |

1 |

Hours |

Dollar Cost |

|

005-00-0007 |

JC |

25:50 |

|

|

Rea. Waaes |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

|

|

|

|

|

|

Salmon, Vicky |

1 |

Hours |

Dollar Cost |

|

006-00-0008 |

JC |

25:50 |

|

|

Rea. Waaes |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

|

|

|

|

|

|

Fisher, Nathan |

1 |

Hours |

Dollar Cost |

|

007-00-0009 |

JC |

25:50 |

|

|

Rea. Waaes |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

|

|

|

|

|

|

Garcia, Daniel |

1 |

Hours |

Dollar Cost |

|

008-00-0010 |

JC |

25:50 |

|

|

Reg. Wages |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

|

|

|

|

|

|

Gould, Janet |

1 |

Hours |

Dollar Cost |

|

009-00-0011 |

JC |

25:50 |

|

|

Reg. Wages |

509 |

|

|

|

P.T.D. Tips |

|

|

|

|

Total Labor Cost |

|

|

|

Figure 1-1: Weekly labor summary tape

|

Field |

Width/Characters |

|

Employee Number |

10 |

|

Employee Name |

12 |

|

Time Card Number |

6 |

|

Job Code 1 |

4 |

|

- Total Time - (HH) |

4 |

|

- Total Time - (MM) |

2 |

|

- Rate |

9 |

|

- Over Time Factor |

5 |

|

- Allowance 1 Amount |

7 |

|

- Allowance 2 Amount |

7 |

|

Job Code 2 |

4 |

|

- Total Time - (HH) |

4 |

|

- Total Time - (MM) |

2 |

|

- Rate |

9 |

|

- Over Time Factor |

5 |

|

- Allowance 1 Amount |

7 |

|

- Allowance 2 Amount |

7 |

|

Job Code 3 |

4 |

|

- Total Time - (HH) |

4 |

|

- Total Time - (MM) |

2 |

|

- Rate |

9 |

|

- Over Time Factor |

5 |

|

- Allowance 1 Amount |

7 |

|

- Allowance 2 Amount |

7 |

|

Period to Date Tips Amount |

11 |

Figure 1-3: Record layout, employee timekeeping file

469851205, "Cannon, E," 000000,0030,0064,01 ,00005.25,1.500,+000.00,+000.00,0010,0064,01, 00005.500, 1.500,+000.00,+000.00,0030,0064,01 ,00005.25,1.500,+000.00,+000.00,+0000000.00

Figure 1-4: Example of the NCR 2160 employee timekeeping record for one employee